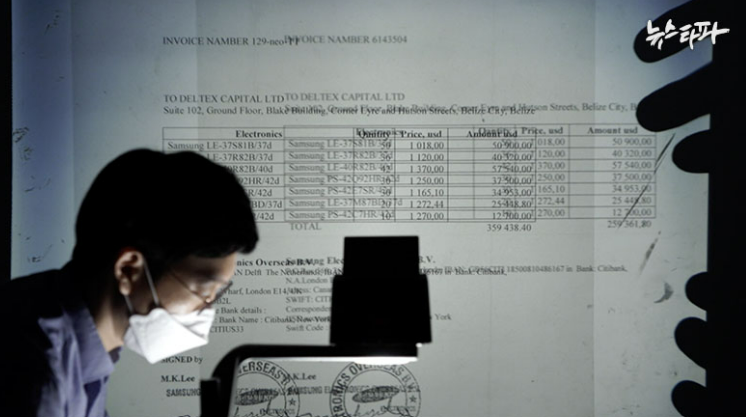

“Most of these LLPs don’t actually do any business at all. I’ve had sights of substantial numbers of bank statements from Danske Bank in Estonia,” Barrow said. “There are hundreds of pages, allegedly, of trading. But it’s all for clinchers. It’s all based on fake contracts. There is no, or very little, goods actually moving about. It’s just paper work. And what does it allow you to do? It allows you to move money in really complicated ways to the point you have no idea where that money came from in the first place.”