Executives at Bokwang and LG ... A Powerful Korean Business Network Found in Bermuda

Dec. 12, 2017

Since 2013, KCIJ-Newstapa has investigated on Koreans who went to tax haven jurisdictions to avoid tax, during which we exposed names of hundreds of Korean individuals and companies.

However, there was a story that we’ve never been able to tell. It’s a story of people who manage the super rich’s asset and actually design the tax dodging and money laundering structures: The attorneys.

Appleby, which triggered publishing of the Paradise Papers, is a law firm with at least 200 attorneys. It is a member of the so-called ‘Offshore Magic Circle,’ an informal inner-circle association of law firms that specialize in offering offshore financing services.

The word ‘magic circle’ originally referred to top five law firms in England, which specialize in legal services related to corporate finance, private banking and trusts.

Borrowing this word, another group of five top law firms headquartered in tax haven jurisdictions were named the ‘offshore magic circle’ as they mainly provide the sames services in tax havens.

Such services provided in tax havens are highly likely to be related to illegal financial schemes like tax evasion or money laundering. Thus, the word ‘offshore magic circle’ is not always used with a positive connotation.

Then, is there a ‘magic circle’ in Korea? If so, what type of firms are they?

Last year, KCIJ-Newstapa investigated documents from the Panama Papers, which exposed a list of Koreans, who maintained shell companies in tax havens, including ex-president Roh Tae-woo's eldest son Ro Jae-hun.

After the investigations, a wealthy man visited our office. This man confessed that he has held a massive amount of wealth in offshore accounts under the name of a shell company in the British Virgin Islands (BVI), and told different stories about the world of tax haven and shell companies.

The most interesting part in his story was about Korean attorneys. The attorneys were the party that first approached him after he succeeded in a business and accumulated a quite big amount of asset himself, he said.

A group of lawyers designed his asset structure, which helped him hiding money and avoiding tax by using tax havens. And all these people were ‘well-off’ attorneys employed at large law firms, the wealthy man explained.

“The largest law firm in Korea even has a separate department for this. I mean, there is a separate department of which the main task is to operate shell companies,” he said, “All attorneys there are those who studied in the Wall Street.”

“This means, attorneys are in charge of most crucial tasks in managing wealthy people's assets,” he added. “Other types of specialists like accountants are also involved in this system, but the attorneys are at the core of this system in charge of designing the ‘master plan.’”

But he emphasized that such services are globally available, meaning that it’s not just a problem of Korea.

“Attorneys who do those jobs exist in every country,” he explained. “Of course, such people exist here in Korea, too. I can't name every one of them, but such law firms and attorneys also exist in Korea.”

Among the files leaked from Appleby, KCIJ-Newstapa identified some documents related to Korean attorneys.

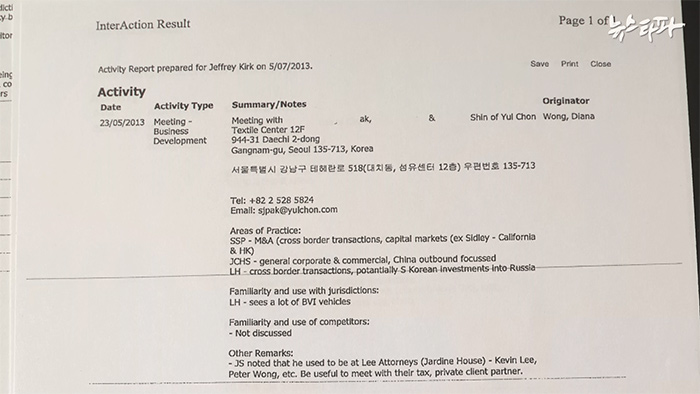

One of them was an activity report written by Appleby attorneys. Two Appleby attorneys, Jeffrey Kirk and Mark Cummings, visited Korea on May 23, 2013, to visit major law firms in Korea. They recorded the meeting minutes with the Korean counterparts in an electronic format.

According to the report, their first destination was Kim & Chang. They had a meeting with three attorneys there, whose surnames were Chung, Park and Baek. Chung was the head of Kim & Chang’s financial department.

“There are negative press coverages on the BVI in Korea nowadays,” Park was reported to have said at the meeting.

Their meeting was held just two days after KCIJ-Newstapa started broadcasting its investigation package on the Offshore Leaks. Back then, KCIJ-Newstapa exposed a shell company held by former president Chun Doo Hwan’s eldest son Chun Jae-kook.

The BVI, which had not been a familiar place for the Korean public, had become widely known as a tax haven after the KCIJ investigations. Park’s remarks seemed to worry such public sentiment.

“But it is still okay as Koreans had more shell companies in the Cayman Islands than in the BVI,” Park reportedly added. “Korean hedge fund managers also tend to use shell companies in the Cayman Islands,” Baek also added.

The Appleby attorneys then visited Lee & Ko, where they met another three attorneys there.

“(Attorneys at Lee & Ko) didn't seem very familiar with shell companies,” the Appleby attorneys wrote in their notes.

They wrote about a Yulchon attorney surnamed Lee that he “has a rich experience with shell companies based in tax havens.”

In addition to local brands like Kim & Chang, Lee & Ko and Yulchon, the Appleby attorneys had visited Seoul branches of foreign firms like Paul Hastings, Clifford Chance and K&L Gates. They also met high-level executives with private equity firm IMM’s office.

KCIJ-Newstapa made inquiries to lawyers at Korea's large-scale law firms who had a meeting with the Appleby counterparts about their relationship with the Bermuda-based law firm. But we didn't hear back from them.

The leaked data from Appleby also included a client list, which the Bermuda-based law firm seemed to have used in managing them closely. The file titled "South Korea" showed names of 71 Koreans, their employers and email addresses.

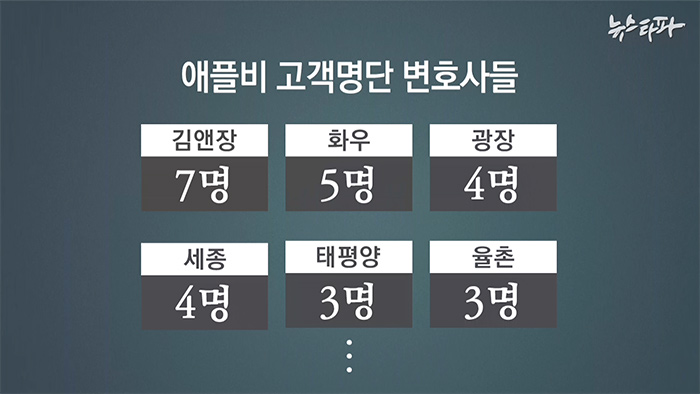

Of 71 individuals, 19 were employees and executives at Korean conglomerates like SK and Korean Air and another nine were those working at local financial companies. However, attorneys accounted for the vast majority of the list.

Nearly half of the list, 35 names were attorneys, and many of them were employees of the nation’s top-notch law firms. Kim & Chang lawyers accounted for the largest part with 7, followed by 5 from Yoon & Yang and each of 4 from Lee & Ko and Shin & Kim.3 lawyers each from Bae, Kim & Lee and Yulchon were also on the list.

Among them included famous lawyers who moved to become law school professors at national universities, and CEOs of well-known law firms.

KCIJ-Newstapa sent an email to 25 of them whose contact information was searchable.

Of 25, we received replies from 7. Three attorneys said that they've never heard of Appleby and think their names were stolen or appeared as a result of personal information leak. Two answered that they've known the Appleby counterparts by simply exchanging name cards at an international conference. Some said they received promotional emails from Appleby after exchanging name cards with employees there.

Only 2 lawyers acknowledged their work-related connection with Appleby. They admitted that tax havens are a hotbed for various illegal transactions, but they emphasized they've never made any illegal activities there.

“I think that hiding bank accounts or assets in those tax haven jurisdictions for tax avoidance purposes is an action that is problematic in both legal and ethical aspects,” an attorney wrote in an email response. “Thus, I explain to my clients in detail on the fact that transactions that may possibly involve tax dodging or hiding assets could be seriously penalized.”

Some attorneys claimed that their job is to actually help businesses or investors.

“If Korean investors have to fully pay taxes to a country where investment takes a place, these investors who have no much options other than overseas investments would end up just contributing in expanding the foreign country's tax revenue,” another attorney wrote in his email response. “So, we think that saving tax expenditure [for Korean investors] is a right decision for their good.

This lawyer's argument is exactly identical to that of Samsung Life Insurance, which avoided tax by investing in London-based property via a Cayman-based shell company.

However, as KCIJ-Newstapa reported earlier, this type of logic only leaves one conclusion regardless of nationality of the money: The fiscal burden caused by tax obligations avoided by the wealthy or conglomerates is directly shifted to the low to mid-income taxpayers.

Lawyers, whom KCIJ-Newstapa was able to reach out, altogether acknowledged the fact that there are some people who abuse tax havens for tax dodging purposes, but claimed that they've never done that themselves.

Of course, we cannot conclude that their arguments are wrong simply because their names were identified in the Appleby's client list or had meetings with lawyers there.

But one certain fact is that a fair number of lawyers in Korea has offered assistance to the wealthy or conglomerates on tax dodging or money laundering using tax haven jurisdictions.

“Would regular companies be able to dare to establish a shell company in tax havens and send money there without assistance from attorneys? The answer can be found there,” Lee Dae-soon, an attorney at Spec Watch Korea, said at an interview with KCIJ-Newstapa. “At least, at the moment when tax evasion via tax havens turn out to be illegal, collaborators to this structure -- including attorneys, accountants and more -- would also appear above the surface for offering help. These collaborators have to be penalized as well. The process of ending this vicious cycle must start there.”

Tax havens and offshore financial system have grown over time in scale, and have become more sophisticated in structure over time. This system, which seems like a fortress, is something that can't be sustained with assistance of the collaborators, like attorneys and accountants.

This is why attorneys must start reflecting themselves, and there is a need of changes in the legal system that may result in changes in the legal circle’s attitude on the issue of offshore financial system.

KCIJ-Newstapa does not accept any advertisement or commercial sponsorship. Individual citizen's voluntary support sustains Korea’s only independent investigative newsroom. You can join our 'Defenders of the Truth' now.