Executives at Bokwang and LG ... A Powerful Korean Business Network Found in Bermuda

2017년 12월 12일 18시 33분

Many names related to entertainment industry were found in the Paradise Papers.

World-class pop singer Madonna, leader of rock band U2 Bono, Queen of Latin pop Shakira, and an English actress Keira Knightley. All these famous names were identified to have invested in an offshore tax haven, or had a company there.

Korea was not an exception. Leaked Appleby documents showed that Korean film industry had a connection with tax havens: An entertainment company of which Actor Jang Dong-gun was the largest shareholder was found to have invested in a film-related shell company in the British Virgin Islands (BVI).

Film 'The Warrior's Way' was released in 2010. It was a blockbuster movie, which cost $52 million (57 billion won) in production. It was a result of joint production between Korea and the U.S. But a Korean film production took a charge of actual production while top Korean actor Jang Dong-gun played the main role.

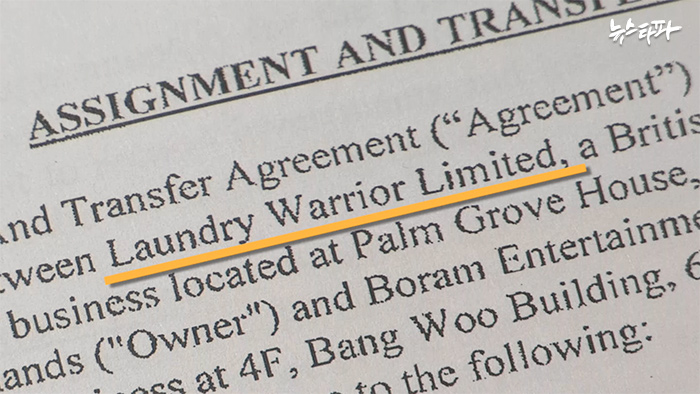

But from a pile of leaked Appleby files, KCIJ-Newstapa found some documents related to production of this film. It was a contract between Korean film production Boram Entertainment and a shell company incorporated in the BVI. The shell company was named 'Laundry Warrior Limited.' It’s an identical same to the initial title of film 'The Warrior's Way' in the early stage of planning process.

According to the contract, Boram is supposed to transfer all rights and interests to this 'Launtry Warrior Limited' with no exceptions allowed. All rights involving the film, including copyrights, are transferred to a shell company in a tax haven. And a signature of the production company Lee Joo-ick is clearly printed on the contract.

Why did he sign the contract? We can infer the reason by looking closely into the following case, a circumstance where a company intentionally tries to move copyrights to a tax haven.

Suppose there's a burger restaurant, which is very popular with crowd of customers. People flock to this particular burger, because of this 'secret sauce.' This restaurant makes lots of money by opening branches in different parts of the globe.

A clever consultant appears who says she can substantially grow the company’s global profits. She suggests him to transfer copyrights of this secret sauce's recipe to an offshore tax haven and start charging foreign branches a fee to use the secret sauce recipe.

He continues, the income from those fees is in a tax haven, and the tax authority in each country cannot impose tax on the fee income.

Likewise, a film's copyrights are same intellectual property just like the secret sauce recipe of this burger restaurant.

If this film succeeds and generates profits, then corporate income for the production company increases. Of course, it has to pay tax on the rising income. But if all rights involving the film belong to a corporate body incorporated in a tax haven, then the shell company becomes the subject of making money. This means, Korean tax authority cannot tax on all types of income involving the film.

Of course, this didn’t happen for ‘The Warrior’s Way,’ because the film failed drawing as many viewers as the production expected.

KCIJ-Newstapa wondered why all copyrights were moved to a shell company based in a tax haven. We visited the production company and asked. We weren't able to meet the CEO Lee Joo-ick, but reached him by phone.

Lee said this film was not successful, so he rather suffered a loss. He continued that it is a normal practice in Hollywood to establish a shell company for each film in tax havens.

“At Hollywood, setting up a separate corporate body for each film in the British Virgin Islands (BVI) is considered an obvious practice,” Lee said. “A fair numbers of large-scale films nowadays have their financial grounds overseas, as foreign money from England, U.S. or China invest in many Korean films.”

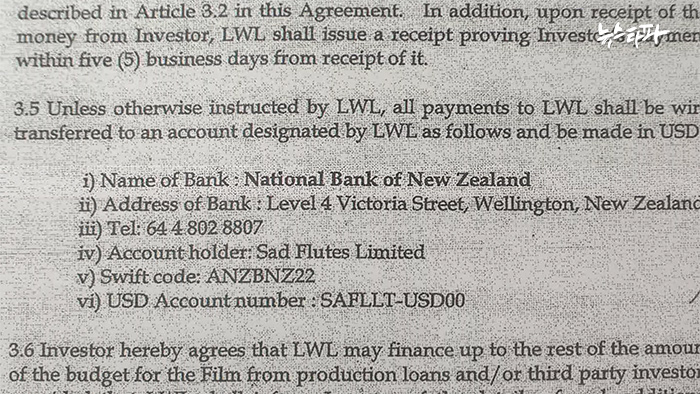

This is a contract for another film, found in the leaked Appleby documents. The document says, a Korean firm called 'Star M' is investing in the 'Laundry Warrior Limited', which is incorporated in the BVI. The investment is worth about $10 million. Under the contract, the money goes into a National Bank of New Zealand account designated by Laundry Warrior Limited.

Star M is a company established by Jang Dong-gun's manager. Jang also was one of the largest shareholders at the time of establishment, owning more than 5 percent. The actor still owned share of 3 to 4 percent when Star M went into this contract with an offshore shell company.

Price of Star M shares surged when Jang received paid-in capital increase and when Jang's investment on the Laundry Warrior Limited was disclosed. The surge came as a so-called 'celebrity impact.'

KCIJ-Newstapa inquired Jang's representative of why Star M, of which Jang was the largest shareholder, invested in a shell company based in an offshore tax haven. We also requested him to show a statement that proves the investment was registered to the tax authority, if he has any.

"It's true that Jang owned a portion of Star M shares, but he didn't have any ideas about the investment detail. He still doesn't, as he wasn't an executive nor an employee at the company. He's never been involved in Star M's management,” a representative of Jang said.

We still have no certain answer on the following questions: Whether the production company transferred the film's copyrights to dodge taxes; why Star M, of which Jang was one of largest shareholders, invested in this shell company; and what was the company going to do if the film actually succeeded attracting viewers?

But one clear fact is that all these investments and distribution of profits were done in the BVI, a tax haven, in a secretive manner. Even if the film production was to bring all the film's profits into Korea and fully pay taxes as it explains, there is no way for us to check if the amount is all or just a part.

뉴스타파는 권력과 자본의 간섭을 받지 않고 진실만을 보도하기 위해, 광고나 협찬 없이 오직 후원회원들의 회비로만 제작됩니다. 월 1만원 후원으로 더 나은 세상을 만들어주세요.